Blog

Employing People in Multiple States Requires Legal Compliance

March 25, 2022

As more companies embrace remote work, they’re often employing people living in different states across the US. State laws differ significantly, so when you employ people in multiple states, you need to ensure that you’re remaining in legal compliance. Here’s what you need to know about employing people in multiple states.

Every state has its own taxing authority, so it is essential for you to register with each state where you have employees and get an ID number so that you can withhold taxes. Tax forms, filing dates, and where you send payments will differ based on the state.

If your employees work in states with a personal income tax, you need to withhold taxes from your employees’ paychecks to comply with the states’ personal income tax. State income tax rates differ in different states.

You’ll also need to pay taxes to fund state unemployment insurance programs. You’ll need to register with the states’ unemployment agencies.

In a few states, such as California and New Jersey, you’ll need to withhold deductions from your employees’ wages to pay the state’s temporary disability insurance program.

There are different labor laws in each state, and you need to make sure you’re in compliance with those as well. For instance, 16 states require employers to provide paid sick leave. Some states mandate equal pay for men and women. Different states have different anti-discrimination laws that you’ll need to comply with. States also all have their own rules regarding workers’ compensation insurance, or insurance that will cover if workers get injured on the job. You may need to buy separate workers’ compensation insurance policies for each state or an “all-states” workers’ compensation policy.

Seven states require paid family and medical leave, and the details of those laws, such as the length of the allowable leave period, employee eligibility requirements, and qualifying reasons for leave, differ by state.

Some states, including California, prohibit or don’t enforce non-competition agreements. Some states have their own rules requiring lunch breaks or rest breaks for employees. And some states have rules around what can and cannot be deducted from employees’ wages. Some states also do not allow employers to mandate direct deposit for paying wages.

There also are different state laws that apply to the job application process. A number of states ban asking job applicants about their salary history. And a number of states ban asking a job applicant about whether they have a criminal history on a job application.

There are other miscellaneous laws that differ by state. For instance, New York state requires employers with 15 or more employees to conduct annual sexual harassment prevention trainings.

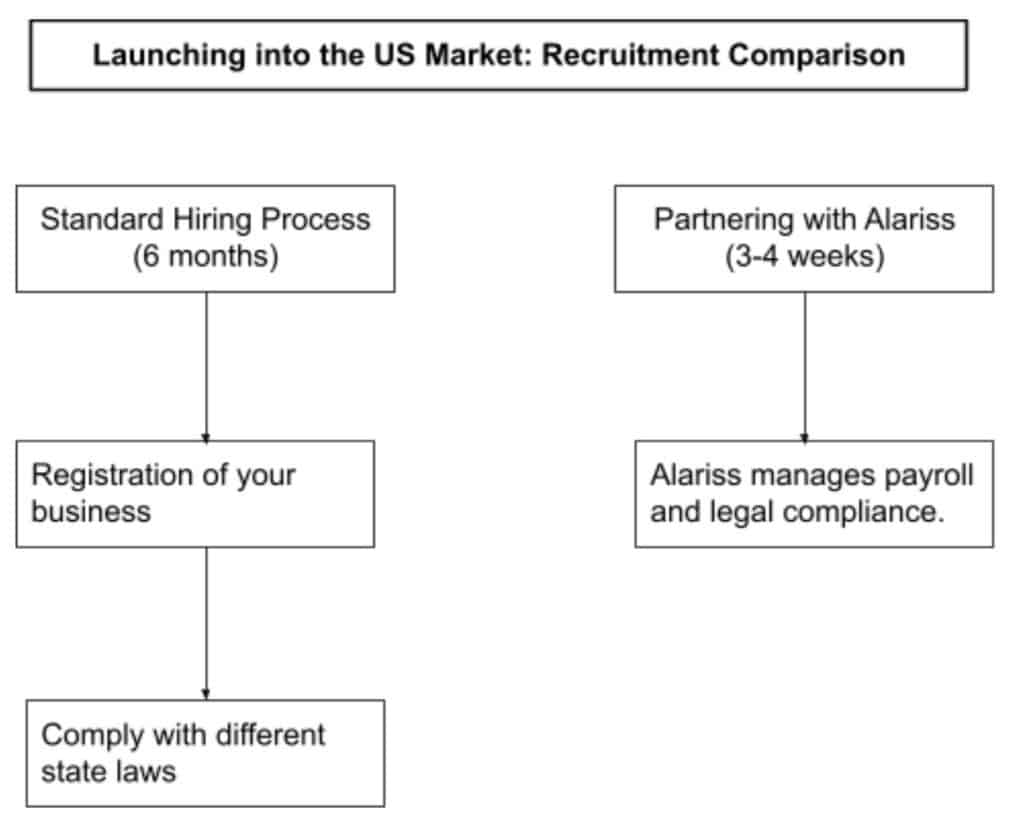

If you work with a company like Alariss, we can take care of all of these legal technicalities for you. When you hire talent through Alariss, we act as the Employer of Record and take care of complying with regulations and taxation in different states. If you’re ready to work with us, book a call with us today.