Blog

The UK’s Startup Scene Is Thriving

March 30, 2022

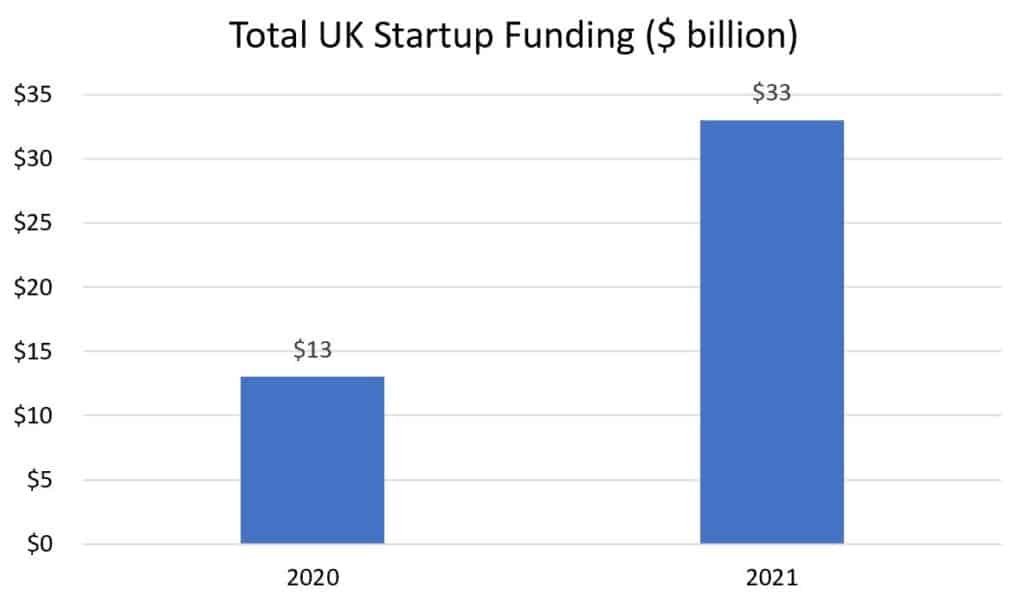

The United Kingdom’s startup scene is thriving. UK-based startups attracted $33 billion in venture capital funding in 2021, according to GlobalData. That is more than double the level in 2020, and deal volume rose 23 percent to 1,866 in 2021.

Startups based in London alone raised nearly $26 billion in 2021, according to a report by London & Partners and Dealroom. The London metro area ranked fourth among metro areas globally for venture capital funding, behind the San Francisco Bay Area, New York City, and Greater Boston, and first in Europe. And the UK ranks fourth globally among countries for venture capital funding, behind the United States, China, and India. The UK ranks first in Europe.

There were 20 new unicorns, or private companies worth more than $1 billion, in London in 2021, bringing London’s total unicorn count to 75. New unicorns in London include Starling Bank, a digital bank; Marshmallow, a digital car insurance company; Motorway, a used car marketplace, and PPRO, a payments platform. There also were 64 megarounds of $100 million or more in funding in London in 2021, including a $800 million Series E for banking company Revolut, two deals totaling $850 million for online events platform Hopin, and more than $600 million across two deals for digital bank Monzo. The combined value of London’s tech companies passed half a trillion dollars in 2021.

London-based VC firms raised $9.9 billion in new funds in 2021. Lightspeed and General Catalyst, VC firms based in the US, recently chose London as their base to expand their footprint in Europe. London-based fintech firms raised 46 percent of all London funding in 2021, while telecom, health tech, and enterprise software companies also raised quite a lot of money. 39 percent of London VC investment came from the US in 2021.

There were a number of IPOs in London in 2021, including for Darktrace, a cybersecurity company, Wise, a money transfer firm, and Deliveroo, a food delivery startup. A number of London companies also went public via SPAC merger in 2021, including Cazoo, an online car retailer; Babylon Health, a telehealth company; and Arrival, an electric vehicle manufacturer. Other public UK tech companies include Just Eat, an online delivery service; Zoopla, a real estate company; Farfetch, a luxury online marketplace; The Hut Group, a retail brand seller; Funding Circle, a small business lending company; and Exscientia, an AI-based drug discovery platform.

The UK has 116 total unicorns, according to CityAM. Three in four UK unicorns are based in London, according to a report by Beauhurst. UK unicorns include Rothesay, a pension insurance specialist; OakNorth, an online bank; OneTrust, a digital security company; and Gymshark, a fitness apparel brand.

If you’re building a startup in the UK, let’s talk. We can help you expand into the US by matching you to top US sales and business development talent and serving as the Employer of Record (EOR) to take care of payroll and legal compliance. If your startup is being built in the UK and made for the world, book a call with us today.